Johan de Witt (nonfiction): Difference between revisions

No edit summary |

No edit summary |

||

| Line 5: | Line 5: | ||

Besides being a statesman, Johan de Witt also was an accomplished mathematician. In 1659 he wrote "Elementa Curvarum Linearum" as an appendix to Frans van Schooten's translation of [[René Descartes (nonfiction)|René Descartes]]' ''La Géométrie''. In this, De Witt derived the basic properties of quadratic forms, an important step in the field of linear algebra. | Besides being a statesman, Johan de Witt also was an accomplished mathematician. In 1659 he wrote "Elementa Curvarum Linearum" as an appendix to Frans van Schooten's translation of [[René Descartes (nonfiction)|René Descartes]]' ''La Géométrie''. In this, De Witt derived the basic properties of quadratic forms, an important step in the field of linear algebra. | ||

In 1671 his Waardije van Lyf-renten naer Proportie van Los-renten was published ('The Worth of Life Annuities Compared to Redemption Bonds'). This work combined the interests of the statesman and the mathematician. Ever since the Middle Ages, a Life annuity was a way to "buy" someone a regular income from a reliable source. The state, for instance, could provide a widow with a regular income until her death, in exchange for a 'lump sum' up front. There were also Redemption Bonds that were more like a regular state loan. De Witt showed - by using probability mathematics - that for the same amount of money a bond of 4% would result in the same profit as a Life Annuity of 6% (1 in 17). But the 'Staten' at the time were paying over 7% (1 in 14). The publication about Life Annuities is seen as the first mathematical approach of chance and probability.[citation needed] After the violent deaths of the brothers the 'Staten' issued new Life Annuities in 1673 for the old rate of 1 in 14. | In 1671 his ''Waardije van Lyf-renten naer Proportie van Los-renten'' was published ('The Worth of Life Annuities Compared to Redemption Bonds'). This work combined the interests of the statesman and the mathematician. Ever since the Middle Ages, a Life annuity was a way to "buy" someone a regular income from a reliable source. The state, for instance, could provide a widow with a regular income until her death, in exchange for a 'lump sum' up front. There were also Redemption Bonds that were more like a regular state loan. De Witt showed - by using probability mathematics - that for the same amount of money a bond of 4% would result in the same profit as a Life Annuity of 6% (1 in 17). But the 'Staten' at the time were paying over 7% (1 in 14). The publication about Life Annuities is seen as the first mathematical approach of chance and probability.[citation needed] After the violent deaths of the brothers the 'Staten' issued new Life Annuities in 1673 for the old rate of 1 in 14. | ||

In 1671 De Witt conceived of a life annuity as a weighted average of annuities certain where the weights were mortality probabilities (that sum to one), thereby producing the expected value of the present value of a life annuity. Edmond Halley’s (of comet fame) representation of the life annuity dates to 1693, when he re-expressed a life annuity as the discounted value of each annual payment multiplied by the probability of surviving long enough to receive the payment and summed until there are no survivors. De Witt's approach was especially insightful and ahead of its time. In modern terminology, De Witt treats a life annuity as a random variable and its expected value is what we call the value of a life annuity. Also in modern terminology, De Witt's approach allows one to readily understand other properties of this random variable such as its standard deviation, skewness, kurtosis, or any other characteristic of interest. | In 1671 De Witt conceived of a life annuity as a weighted average of annuities certain where the weights were mortality probabilities (that sum to one), thereby producing the expected value of the present value of a life annuity. Edmond Halley’s (of comet fame) representation of the life annuity dates to 1693, when he re-expressed a life annuity as the discounted value of each annual payment multiplied by the probability of surviving long enough to receive the payment and summed until there are no survivors. De Witt's approach was especially insightful and ahead of its time. In modern terminology, De Witt treats a life annuity as a random variable and its expected value is what we call the value of a life annuity. Also in modern terminology, De Witt's approach allows one to readily understand other properties of this random variable such as its standard deviation, skewness, kurtosis, or any other characteristic of interest. | ||

Revision as of 19:00, 3 July 2017

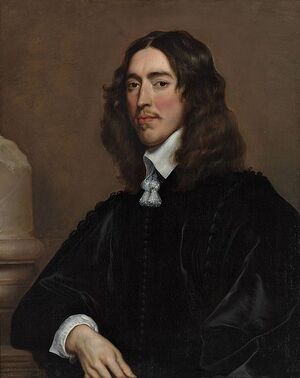

Johan de Witt or Jan de Witt, heer van Zuid- en Noord-Linschoten, Snelrewaard, Hekendorp and IJsselveere (24 September 1625 – 20 August 1672) was a key figure in Dutch politics in the mid-17th century, when its flourishing sea trade in a period of globalisation made the United Provinces a leading European power during the Dutch Golden Age. De Witt controlled the Netherlands political system from around 1650 until shortly before his death in 1672, working with various factions from nearly all the major cities, especially his hometown, Dordrecht, and the hometown of his wife, Amsterdam.

As a republican he opposed the House of Orange-Nassau. He was also strongly liberal, preferring lesser power to the central government and more power to the regenten. However, his negligence of the Dutch land army (as the regents focused only on merchant vessels, thinking they could avoid war) proved disastrous when the Dutch Republic suffered numerous early defeats in the Rampjaar (1672). In the hysteria that followed the effortless invasion by an alliance of three countries, he and his brother Cornelis de Witt were blamed and lynched in The Hague, whereafter rioters partially ate the brothers. The rioters were never prosecuted, and historians have argued that William of Orange may have incited them.

Besides being a statesman, Johan de Witt also was an accomplished mathematician. In 1659 he wrote "Elementa Curvarum Linearum" as an appendix to Frans van Schooten's translation of René Descartes' La Géométrie. In this, De Witt derived the basic properties of quadratic forms, an important step in the field of linear algebra.

In 1671 his Waardije van Lyf-renten naer Proportie van Los-renten was published ('The Worth of Life Annuities Compared to Redemption Bonds'). This work combined the interests of the statesman and the mathematician. Ever since the Middle Ages, a Life annuity was a way to "buy" someone a regular income from a reliable source. The state, for instance, could provide a widow with a regular income until her death, in exchange for a 'lump sum' up front. There were also Redemption Bonds that were more like a regular state loan. De Witt showed - by using probability mathematics - that for the same amount of money a bond of 4% would result in the same profit as a Life Annuity of 6% (1 in 17). But the 'Staten' at the time were paying over 7% (1 in 14). The publication about Life Annuities is seen as the first mathematical approach of chance and probability.[citation needed] After the violent deaths of the brothers the 'Staten' issued new Life Annuities in 1673 for the old rate of 1 in 14.

In 1671 De Witt conceived of a life annuity as a weighted average of annuities certain where the weights were mortality probabilities (that sum to one), thereby producing the expected value of the present value of a life annuity. Edmond Halley’s (of comet fame) representation of the life annuity dates to 1693, when he re-expressed a life annuity as the discounted value of each annual payment multiplied by the probability of surviving long enough to receive the payment and summed until there are no survivors. De Witt's approach was especially insightful and ahead of its time. In modern terminology, De Witt treats a life annuity as a random variable and its expected value is what we call the value of a life annuity. Also in modern terminology, De Witt's approach allows one to readily understand other properties of this random variable such as its standard deviation, skewness, kurtosis, or any other characteristic of interest.

In the News

Fiction cross-reference

Nonfiction cross-reference

External links:

- de Witt Johan de Witt @ Wikipedia

Attribution: